Digital Wallet Meets Digital Lifestyle: Exploring the Samsung Money Account by SoFi sets the stage for an examination of how this innovative financial product integrates seamlessly into modern life. We’ll delve into the features, benefits, and overall user experience, considering its practicality and appeal within the broader context of digital banking and mobile payments. This exploration aims to provide a comprehensive understanding of the Samsung Money Account’s place in the evolving landscape of personal finance.

The convergence of digital wallets and our increasingly digital lifestyles is reshaping how we manage finances. A prime example of this evolution is the Samsung Money Account by SoFi, a compelling offering that seamlessly integrates financial management into the everyday experience of Samsung device users. This comprehensive guide delves into the features, benefits, and considerations of this innovative financial tool, exploring its potential to simplify your life and enhance your financial well-being.

Understanding the Samsung Money Account: A Deep Dive

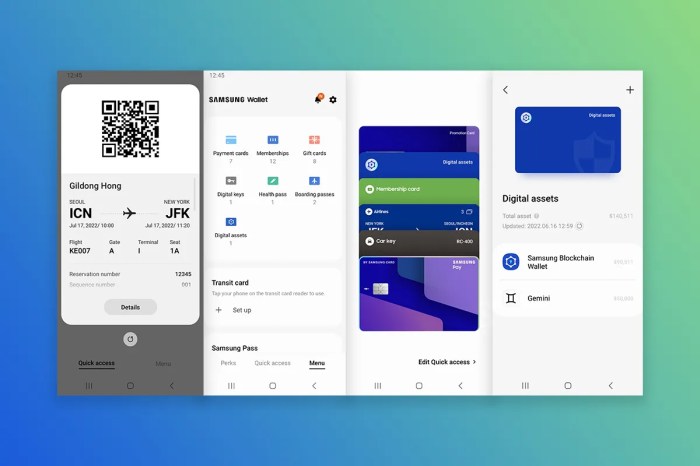

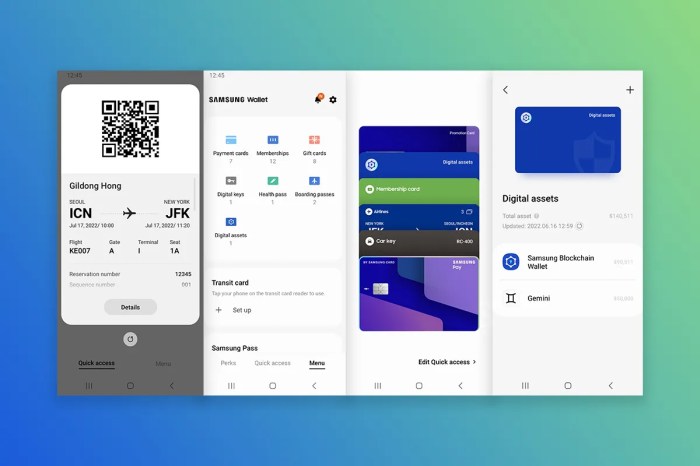

The Samsung Money Account, powered by SoFi, is more than just a digital wallet; it’s a comprehensive financial ecosystem designed for convenience and accessibility. It leverages the familiarity and ubiquity of Samsung devices to provide a streamlined banking experience directly within the Samsung Pay app. This eliminates the need for multiple apps and logins, consolidating your financial tasks into a single, intuitive platform.

Key features include:

Key Features of the Samsung Money Account:

- Debit Card Functionality: Enjoy the convenience of a virtual and physical debit card linked to your account, allowing for seamless online and in-person purchases.

- No Monthly Fees: Unlike many traditional bank accounts, the Samsung Money Account typically doesn’t charge monthly maintenance fees, making it a cost-effective option.

- Direct Deposit: Receive your paycheck or other payments directly into your Samsung Money Account, streamlining your income management.

- ATM Access: Access your funds at a vast network of ATMs, providing widespread cash withdrawal capabilities.

- Mobile Check Deposit: Deposit checks remotely using your smartphone’s camera, saving time and trips to the bank.

- Personalized Financial Management Tools: Access budgeting tools and insights to track spending and improve financial literacy.

- Integration with Samsung Pay: Seamless integration with Samsung Pay for effortless contactless payments.

- High-Yield Savings Account Option (often available): Many users can also link a high-yield savings account, maximizing returns on their savings.

- Customer Support: Access to SoFi’s customer support channels for assistance with account management and inquiries.

Benefits of Using the Samsung Money Account

The Samsung Money Account offers a multitude of benefits, particularly for users who prioritize convenience, accessibility, and streamlined financial management. These advantages include:

Advantages of the Samsung Money Account:

- Enhanced Convenience: Manage your finances directly from your Samsung device, eliminating the need for separate banking apps.

- Cost Savings: Avoid monthly maintenance fees and potentially save on ATM fees through SoFi’s network.

- Improved Security: Benefit from the security features offered by both Samsung Pay and SoFi, including fraud protection and advanced encryption.

- Streamlined Budgeting: Utilize integrated budgeting tools to gain better control of your spending habits.

- Increased Financial Literacy: Access educational resources and insights to enhance your understanding of personal finance.

- Seamless Integration: Enjoy the effortless integration with other Samsung services and apps.

Considerations Before Opening a Samsung Money Account

While the Samsung Money Account offers numerous advantages, it’s crucial to consider certain aspects before opening an account. These include:

Factors to Consider:, Digital Wallet Meets Digital Lifestyle: Exploring the Samsung Money Account by SoFi

- Eligibility Requirements: Ensure you meet the eligibility criteria set by SoFi, which may include age restrictions and residency requirements.

- Fees and Charges: While the account typically doesn’t charge monthly fees, be aware of potential fees for specific services, such as overdraft protection.

- ATM Access: While ATM access is generally available, confirm the network’s coverage in your area to avoid unnecessary fees.

- Customer Support Availability: Evaluate the availability and responsiveness of SoFi’s customer support channels.

- Security Measures: Understand the security protocols in place to protect your financial information.

- Account Limits: Be aware of any transaction limits or restrictions imposed on the account.

Samsung Money Account vs. Traditional Banking: A Comparison

Comparing the Samsung Money Account to traditional banking reveals key differences in approach and functionality. Traditional banks often offer a wider range of services but may lack the seamless integration and convenience of a digital-first solution like the Samsung Money Account. The latter excels in user experience and accessibility for those comfortable with digital banking. The best choice depends on individual needs and preferences.

Frequently Asked Questions (FAQs)

- Q: Is the Samsung Money Account FDIC insured? A: While SoFi Bank, N.A. is a member of the FDIC, the specific insurance coverage may vary depending on the account type and balances. Check SoFi’s website for details.

- Q: How do I open a Samsung Money Account? A: The process typically involves downloading the Samsung Pay app, verifying your identity, and completing the account application through the app.

- Q: What are the requirements to open an account? A: Requirements generally include being a legal resident of the US and meeting age restrictions. Specific requirements may vary, so refer to SoFi’s official website.

- Q: What happens if my card is lost or stolen? A: SoFi offers security features and processes for reporting lost or stolen cards. Contact SoFi’s customer support immediately to cancel your card and prevent unauthorized transactions.

- Q: Can I use the Samsung Money Account internationally? A: While it’s designed for domestic use, check with SoFi for details on international transaction capabilities and associated fees.

- Q: How do I access customer support? A: SoFi typically provides various support channels, including phone, email, and online help resources. Details are available on their website.

Conclusion: Embracing the Future of Finance: Digital Wallet Meets Digital Lifestyle: Exploring The Samsung Money Account By SoFi

The Samsung Money Account by SoFi represents a significant step towards a more integrated and user-friendly financial experience. By leveraging the convenience of Samsung devices and the capabilities of SoFi’s financial platform, it offers a compelling alternative to traditional banking for those seeking a streamlined, digital-first approach to managing their finances. While individual needs vary, the Samsung Money Account deserves consideration for its potential to simplify your financial life.

References:

For further information and to access the most up-to-date details, please visit the official SoFi website: [Insert SoFi Website Link Here]

For information on Samsung Pay, please visit: [Insert Samsung Pay Website Link Here]

Call to Action:

Ready to simplify your financial life? Explore the Samsung Money Account by SoFi today and experience the convenience of integrated financial management. [Insert Link to SoFi Account Application Here]

Ultimately, the Samsung Money Account by SoFi presents a compelling blend of convenience and financial management tools within the familiar environment of a digital wallet. Its integration with Samsung devices streamlines transactions and provides a user-friendly interface for everyday banking needs. While certain limitations may exist, the account’s overall functionality and potential for future development make it a noteworthy player in the competitive field of digital banking solutions.

Key Questions Answered

What are the fees associated with the Samsung Money Account?

Fees vary depending on usage. Check the SoFi website for the most up-to-date fee schedule.

Is the Samsung Money Account FDIC insured?

Yes, deposits are FDIC insured up to the standard limits.

What types of cards are available with the account?

Typically, a debit card is offered for access to funds.

How do I contact customer support for the Samsung Money Account?

Contact information can be found on the SoFi website or within the Samsung Pay app.